PHH and TCB Transition

Assumption of Agreements

As part of the transition, PHH Mortgage will assume the contracts of all TCB clients on a prospective basis. The assumption will apply differently based on whether you are an existing approved PHH Mortgage seller or not. The assumption will apply as detailed below.

- Sellers approved with TCB Only – Your agreement will be assumed by PHH with the same authority to commit and sell loans as you have today with TCB. If there are any agreement terms that need to be specifically addressed, you will be contacted by PHH to address the situation. At a future point, most likely when you go through recertification, you will be asked to sign a new agreement with PHH Mortgage.

- Sellers approved with TCB and PHH – All commitments with PHH will be governed by the PHH agreement. The TCB agreement will only apply to any commitments extended directly by TCB. For example, mandatory commitments on or after June 1 will be offered by PHH Mortgage and fall under the PHH Mortgage agreement.

Mandatory and Best Efforts Lock Commitments

- Mandatory Commitments Transition to PHH – Beginning June 1st, all mandatory delivery commitments will be taken via the PHH Rate Lock Desk (mandatory commitment desk) at ratelock@phhmortgage.com. The TCB mandatory commitment desk will cease offering commitments with the close of desk hours on Friday May 28th.

- Best Efforts Commitment Transition to PHH – Beginning on June 21st, all best efforts locks will be taken via PHH. The last day to commit best efforts locks to TCB will be June 18th. We will communicate any changes related to managing any remaining pipeline of TCB best efforts locks as we move closer to the transition date.

Delivery of Mandatory Loan Files and Final Documents

The key dates for the transition related to delivery of loan files and final documents are as detailed below

- Loan File Delivery – The last day to upload files for delivery to the TCB Platform will be June 25th for both Mandatory and Best Effort Locks. Upload capability for the initial delivery of a loan file will not be available after June 25th. Files delivered to TCB June 25th or earlier will be reviewed, cleared and purchased by TCB. Beginning June 28th, all files locked with TCB should be delivered via upload through PHH TPOC portal. Original TCB commitments delivered to PHH will be reviewed, cleared, and purchased by PHH.

- Original Note/Bailee Docs for Mandatory Transition to PHH- Beginning with June 1st locked loans, all Original Notes/Bailee Docs must be directly sent to the following in order for PHH to purchase the loan:

Wells Fargo CTS-PHHO

1100 Virginia Drive, Suite 100

190-FTW-030

Fort Washington, PA 19034-3276 - Final/Trailing Documents for Mandatory Lock Loans- Beginning with June 1st locked loans, all final documents listed in Chapter 10 of the PHH Seller Guide, including recorded Mortgages/DOT and Final Title Policies, should be delivered electronically. Final documents may be uploaded to the loan file via TPO Connect using the following instructions.

Please do not mail the documents. We appreciate your support to a paperless environment.

To upload in TPO Connect:

- Open the loan via your pipeline.

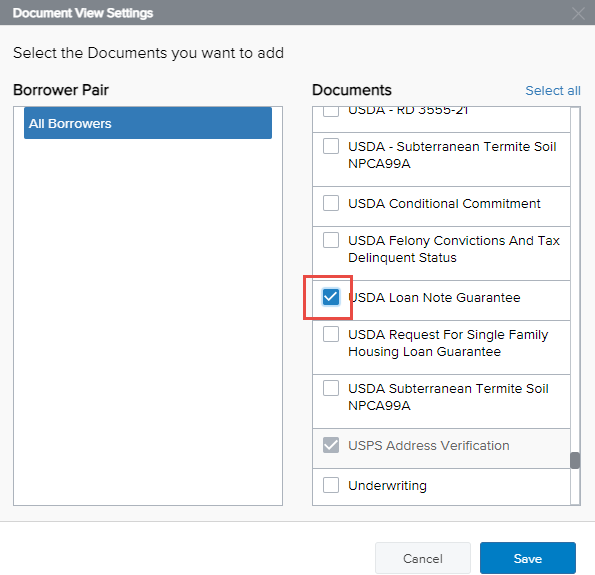

- Under Documents, scroll down to the document placeholder shown in the below chart.

- If the document placeholder listed is not available, please click “+Add Document”, then scroll until you locate the document placeholder. Click the box next to the placeholder to add, then hit Save.

- If the document placeholder listed is not available, please click “+Add Document”, then scroll until you locate the document placeholder. Click the box next to the placeholder to add, then hit Save.

- Click on “Browse for Files” or “Drag and Drop files here” to attach the document.

- Exit the loan.

| Final Document | Document Placeholder |

|---|---|

| Mortgage Insurance Certificate (MIC) | FHA Mortgage Insurance Certificate |

| Loan Guarantee Certificate (LGC) | VA Loan Guarantee Certificate |

| USDA Loan Note Guarantee | USDA Loan Note Guarantee |

| Title Policy | Final Title Insurance Policy |

| Recorded Mortgage/DOT | Recorded Security Instrument |

If you have Final/Trailing Doc questions, please contact your Correspondent Specialist or the Final Doc Team at PHHCLPost-Funding@phhmortgage.com.

PHH Servicing Information – For All Loans Delivered on the PHH Platform

| Type | Contact Information |

|---|---|

| Goodbye Letter Information | Regular Mail: PHH Mortgage 500 Ross Street Pittsburgh, PA 15250-7458 (800) 449-8767 |

| PHH Overnight Payment Address | PHH Mortgage Attn: 371458 500 Ross Street Pittsburgh, PA 15250-7458 |

| Payments Received by Seller Due to PHH | PHH Mortgage 1 Mortgage Way SV 19 Mount Laurel, NJ 08054 |

| Servicing Transfer ORG ID’s | MERS ID 1000200 FHA Lender ID: 30275-0990 USDA ID: 222195996 / Branch #001 |

In Closing

For TCB clients new to PHH, you should have already been contacted by your sales representative to arrange a welcome call and engaged in any training to aid you in being ready to do business with PHH Mortgage. Should that not have happened, please contact us so we can make sure we arrange to do so. If you have any general questions about the transition, please contact your sales representative.

We are very enthusiastic about the potential of our combined business. It is our priority to offer you competitive commitment options and great service that make it easy for you to do business with PHH Mortgage. We will continue to focus on earning your business every day.