Disaster Policy Reminder

The announcement is an update to the PHH Mortgage Seller Guide (“Guide”). The requirements contained herein and in previous announcements are incorporated into the Guide, and they are considered a part of and supplement the Guide.

In light of recent disaster declarations in the state of Texas, attached is a reminder of PHH Mortgage’s Disaster Policy.Please note, PHH will accept a lender certification prior to purchase in lieu of a 1004D or Disaster Inspection when the following are met for conventional loans only:

- The lender’s certification must be executed by an officer of the company.

- The lender’s certification must be specific to the property in the declared disaster area and must indicate that there is no damage to the property.

Government insured loans must met HUD, VA and USDA requirements.

If you have any questions, please feel free to contact your Account Executive or PHH at 1-800-929-4744 or PHHCorrSupport@phhmortgage.com. Thank you for your continued business.

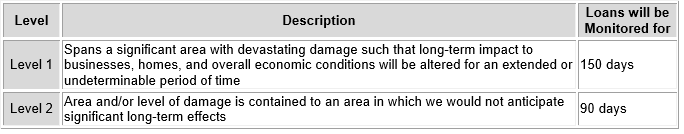

Overview of Disaster Policy

The magnitude of the disaster (Level 1 or Level 2) will drive the period of time for which the disaster will be monitored. The Disaster Monitoring Period is defined as beginning on the Date of Occurrence for the disaster as issued by FEMA and ending on the Monitoring Period Expiration date, determined by the disaster level, and is documented in the table above. All loans in the pipeline or registered during the monitoring period must meet all disaster related requirements.

Disaster Requirements

When the property securing the loan is located in an area that FEMA has declared a Major Disaster Area eligible for individual assistance, the following requirements apply. These requirements are applicable for any loans registered, or existing loans in pipeline that have not yet funded, during the Disaster Monitoring Period. In the event of multiple or on-going adverse events, the required documentation must be obtained after the most recent event.

The inspection requirements below also apply for loans closed and not yet sold, or not yet endorsed for insurance or guaranteed.

In addition to agency requirements, the following must be met for any property located in a disaster area to confirm the property has not been adversely affected by the disaster at the time of sale:

-

An exterior disaster inspection certification with color photographs is required, if the agency does not require a disaster inspection, when:

- An appraisal was not originally needed, or

- The appraisal was completed on or before the disaster incident period end date.

- Disaster inspection certification must be completed after the incident period end date as defined by FEMA.

- Disaster inspection must indicate any repairs needed and evidence repairs have been completed must be provided.

- This policy must be followed for 90 days after the end date of a declared disaster.

Properties Appraised Prior to Date of Disaster

A 1004D or a Disaster Inspection Certification and color photographs are required of the exterior of the property and subject neighborhood.

The inspector must provide a certification, on the inspector’s letterhead, stating the following:

- An exterior inspection has been completed

- The property is free from damage and is in the same condition as previously appraised

- Marketability of the property is unchanged

- If repairs were needed and have been completed, this must be stated and repairs evidenced as complete

- The inspection may be completed by any of the following:

- A properly licensed property or building inspection company

- A properly licensed general contractor

- A building or safety inspector from a local municipality

- A properly licensed engineer if necessary o A licensed appraiser is required to complete the inspection for a conventional purchase

PHH will also allow for lender certifications and photos in lieu of a 1004D or Disaster Inspection Certification when the following requirements are met for conventional loans only:

- The lender’s certification must be executed by an officer of the company.

- The lender’s certification must be specific to the property in the declared disaster area and must indicate that there is no damage to the property.

- Photos taken/provided by the lender must be date stamped. *Photos not required for disaster DR-4586

Note: If the loan type is FHA, the Seller must follow FHA guidelines for reinspection of the property. The disaster inspection report must be completed by an FHA Roster Appraiser.

Properties Appraised After the Incident Period End Date of Disaster

The appraiser must note any damage and its effect on marketability and value. The appraiser must make any applicable repair requirements.